REAL CREDIT REPAIR: LET THE EXPERTS TAKE CARE OF YOU!

We Specialize In Helping People To

Eliminate Thousands Of Dollars

Worth Of Debt Off Your Credit Report

We Specialize In Helping People To Eliminate Thousands Of Dollars Worth Of Debt Off Your Credit Report

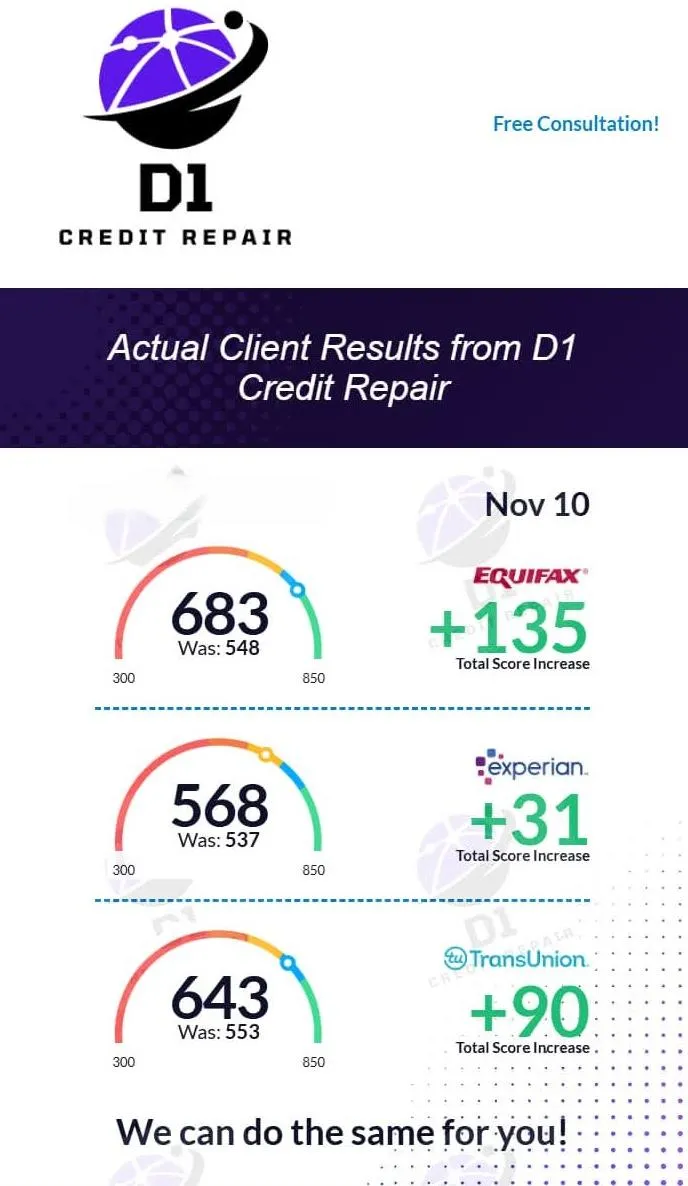

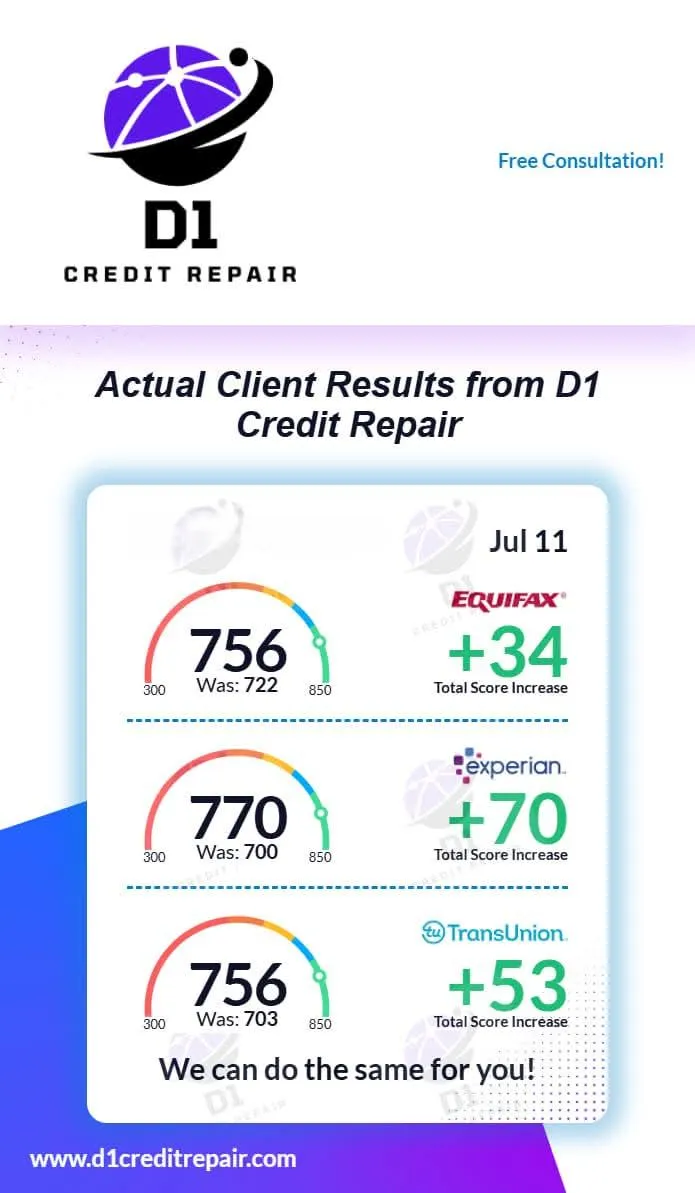

HERE WHAT OUR CLIENTS HAVE TO SAY...

We Also Have The Most Aggressive & Quickest Credit Cleaning Strategy To Bring Your Credit Score Back Up!

We Use The Power of The Consumer Law to

Remove Common Credit Report Errors Like:

We Use The Power of The Law to Remove Common Credit Report Errors Like:

- Late Payments

- Collections

- Hard Inquiries

- Charged-Offs

- Bankruptcies

- Student Loans

- Judgements

- Repossessions

- Foreclosures

- And Much More...

- Late Payments

- Collections

- Hard Inquiries

- Charged-Offs

- Bankruptcies

- Student Loans

- Judgements

- Repossessions

- Foreclosures

- And Much More...

Here Is How Our Credit Repair Process Works

- Step 1: Credit Analysis

We go over your credit report with you to find negative items that are inaccurate, help you understand the process of credit repair, and prepare a plan of action with you to improve your credit.

- Step 2: Dispute

We work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score using our legal team.

- Step 3: Track Progress

Sit back and let us handle the work. You can see your client portal 24/7 for live status updates on improvements on your credit report.

- Step 4: Credit Restoration

We will do our best to maximize your results using our custom tactics on the bureaus so you can restore your credit and achieve your credit goals.

- Step 1: Credit Analysis

We go over your credit report with you to find negative items that are inaccurate, help you understand the process of credit repair, and prepare a plan of action with you to improve your credit.

- Step 2: Dispute

We work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score using our legal team.

- Step 3: Track Progress

Sit back and let us handle the work. You can see your client portal 24/7 for live status updates on improvements on your credit report.

- Step 4: Credit Restoration

We will do our best to maximize your results using our custom tactics on the bureaus so you can restore your credit and achieve your credit goals.

FAQ'S

Credit Repair is actually the process of removing inaccurate, unfounded, out of date, false, and erroneous information from your credit report. Your credit report dictates your credit score. The 3 major credit bureaus collect information from lenders, creditors, and debt collectors and apply it to your credit report. Based on that information, your credit score is determined. This information could include the balances on loans or credit cards, credit inquiries, debt to income ratio, and most importantly, credit utilization (the percentage of debt you have to available credit)

Can You Remove Anything From My Credit Report?

We can only fight to remove any items that fall under the guidelines of the FCRA. These are items that should be removed due to being inaccurate, unfounded, out of date, false and/or erroneous.

How Much Does It Cost?

The price varies depending on what you have on your credit report. To get a proper estimate, please book a FREE Consultation + Credit Analysis Appointment with a credit expert by clicking the Button below:

Is Credit Repair Legal?

Credit repair is legal and governed by the Fair Credit Reporting Act (FCRA), which gives consumers the right to dispute inaccurate, incomplete, or unverifiable information on their credit reports. Credit bureaus and creditors are required to investigate disputes—typically within 30 days—and remove or correct items that cannot be properly verified. Studies continue to show that many credit reports contain errors or outdated information, which is why clients often see improvements once disputes are submitted. At D1 Credit Repair, we use compliant, strategic documentation to enforce your consumer rights and hold reporting agencies accountable.

New! Self-Sign Up Is Here — Get Started in Minutes...

Signing up is quick and easy. Simply click the Self-Sign Up button, follow the guided prompts, and complete your enrollment in just a few minutes. Our step-by-step process makes it simple to get started, and if you have any questions along the way, our team is always available to assist and provide support whenever you need it.

Copyright 2022

All rights reserved.

Facebook

Instagram

Youtube